Why you shouldn’t always build for the ‘happy path’ – Interview with Sam Richardson of Twilio

May 23, 2022

Little personal touches can make all the difference – Interview with Jawad Malik of Idrese

May 30, 2022This is a guest post from Satish Krishnamurthy, Global Practice Head – BFSI at Tech Mahindra.

Imagine the seamlessness of ordering on Amazon or hailing a cab on Uber or completing a loan application ‘on the go’ on any of the new gen FinTech. The exposure to such intuitive, humanized & personalized experiences day-in, day-out has triggered a paradigm shift in customer expectations. The overall benchmark of best-in-class CX has been raised in the customer mindset forcing the traditional industries to quickly cover the ground instead of risking their share of wallet & diluting their brand by providing a sub-optimal CX.

According to Gartner’s marketing insights, ‘Customer experience (CX) is the new marketing battlefront. More than two-thirds of marketers responsible for CX say their companies compete mostly based on CX.’

Financial Services industry is not an exception to this phenomenon especially with the emergence of FinTechs – aggregators, marketplaces (all non-banks) which have started to pose a serious challenge to the legacy Financial Services market leaders. It’s like a tug of war between the traditional and contemporary players in the financial services industry. Moreover, the banking industry is a commoditized space with everyone offering nearly the same products and services without much room to compete on price, the experience customers have with their banks is what gives one bank a competitive advantage over another. So, the largest competitive advantage for a bank is differentiated customer experience.

Customer experience remains the primary focus for banks that are looking for ways to improve it by simplifying customer journeys and introducing omnichannel experiences. Banks rely on data to define customer journeys, drive decision making and to optimize cost structures. Digital Transformation in Banking empowering seamless customer experience across all popular channels.

Technology adoption will be the norm going forward to build resiliency in a challenging & adverse market condition.

The role of customer engagement in Financial Services Industry is fast evolving from back office, secondary support group to self-sustaining sales & service unit generating clients, revenue, and value. Interestingly, some of the reasons triggering evolution in banking are:

- Economic Pressures

- New Competitors (FinTech)

- Digital exposure of clients

- Customer attrition due to poor CX

Alongside, there have been few macro developments which have altered the operating landscape for Financial Services industry.

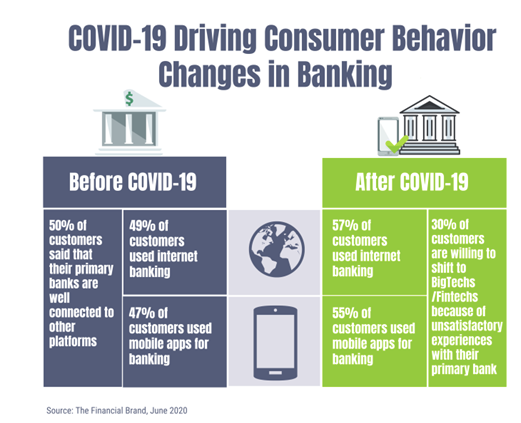

Sustaining the COVID brought “NEW NORMAL”

During the onset of Covid-19 pandemic, the banking sector witnessed a major shift. According to KPMG2020, ‘Covid-19 has accelerated the need for new banking market specific technologies and cost-cutting efficiencies such as Cloud technologies, digital applications and AI. These technologies have gained higher traction to weather the changes & differentiate offerings in the long term.’ Besides, Deloitte reported that ‘a short-term disruption is likely to lead to accessibility concerns and scaling-down of SME/corporate customers’ and that a more prolonged crisis is likely to increase customer preference towards digital channels and products such as insurance, in addition to defaults by SMEs/corporates.’ The pandemic has forced banks to transform their decision-making processes and focus aggressively on costs and customer experience. Covid-19 has also placed banks under extreme stress as revenue sources plummet and credit risks have risen exponentially.

Dramatic shifts in consumer habits

The traditional banking model was already being challenged pre-Covid. It has also changed consumers’ behaviors, pushing them to consider new tools and technologies. As customers become “digital first” across all age groups the traditional banking model of separate and often unintegrated channels comes into question.

The traditional banking model was already being challenged pre-Covid. It has also changed consumers’ behaviors, pushing them to consider new tools and technologies. As customers become “digital first” across all age groups the traditional banking model of separate and often unintegrated channels comes into question.

Here are some stats which shows the sudden change in customer behavior:

- 57% of consumer prefer internet banking –World Retail Bank 2020

- Only 37% of customers believe that banks understand their needs and preferences adequately.

- Salesforce states that 62% of consumers expect companies to adapt based on their action and behavior.

Reframing customer experience in banking

Digital transformation has forever changed the way a bank interacts with its customers, and the pandemic only served to accelerate the changes. However, beyond simply adopting new technologies, banks are looking inwards and re-evaluating the role of CX in delivering business value.

According to Salesforce, 47% of consumer believe that they are receiving the personalized service today. While a recent special report from the non-profit Bank Administration Institute (BAI) indicates that more than half (57%) of consumers would consider banking with non-traditional financial organizations. Further, by 2024, customers expect 61% of their banking business to be fully digital and only 39% human-assisted, with the biggest projected increases coming from mobile and ATM usage.

At the top of consumers’ wish list is improvement in the omni channel experience with their financial institutions, driving a more satisfying customer experience (CX) overall. KPMG claims that new technologies will drive banking transformation over the next 5 years. Cloud and SaaS has allowed banks to operate with an agility and speed usually associated with their FinTech competitors. More so, artificial intelligence will separate the winners from the losers in banking. There are a diverse range of uses for AI, with a growing focus on improving the customer experience through personalization.

In the new world, banking will become part of a platform of services with the key players transforming their business models into digital ecosystems and making the bank the center of these platforms.

Trends in digital customer experience in Financial Services

The industry is undergoing a strategic change with focus shifting from organizational product to designing around customer needs.

-

Hyper-personalized experiences

It’s no secret that personalization is important for banking customers; after all, the CX list of trends has been going on for years. And banks are benefiting too. Hyper-personalization can only be achieved if you have access to in-depth data about your consumers. Banks are best positioned when it comes to customer data, demographics simply by virtue of the KYC requirements and the ongoing requirement of monitoring Customer transactions to mitigate any financial risks. Unfortunately, despite access to such rich data in comparison to other industries, banks are lagging in leveraging the same to personalize customer engagement.

It’s no secret that personalization is important for banking customers; after all, the CX list of trends has been going on for years. And banks are benefiting too. Hyper-personalization can only be achieved if you have access to in-depth data about your consumers. Banks are best positioned when it comes to customer data, demographics simply by virtue of the KYC requirements and the ongoing requirement of monitoring Customer transactions to mitigate any financial risks. Unfortunately, despite access to such rich data in comparison to other industries, banks are lagging in leveraging the same to personalize customer engagement.

-

Omni Channel Delivery

Provide consumers with a consistent experience from touchpoint to touchpoint. If a customer started their interaction with your brand on social media, this experience would continue as the customer moves onto your mobile app and website. Customers should not have experience gaps as they move across channels. A customer should be able to start a journey in one channel, pause on it if required, move easily to another channel to be picked up later to complete the same journey. Customers should be able to choose products or services from the location and channel of their choice with convenience and still have a consistent experience.

-

Predictive Analytics

Predictive analytics makes use of previous consumer data, statistical algorithms, and machine learning to pinpoint future outcomes by helping brands determine consumer responses and behavior.

-

Mobile CX is priority

Customer self-help is one of the fastest growing trends for bank customers. Thanks to mobility, customers now can fully access their banking services from their mobile phones wherever they have Wi-Fi, transforming what was once a dream into a basic anticipation. If your institution already has a mobile or newly built banking app, the next step is to determine if you are using that app’s data effectively. According to Forbes, 57% of customers won’t recommend a business with a poor CX on mobile. By not providing a positive experience, you are putting your business growth in jeopardy.

-

AI/Bots to help lead the way

There is nothing more frustrating for a customer than calling their bank customer service number to report a problem, and then wait on hold. As the volume of incoming calls grows steadily and there are not enough representatives to speak, it becomes a difficult situation for financial institutions. Instead of waiting on the phone, customers now have the option of contacting AI-enabled chat bots when faced with challenges. These chat-bots draw and process information from a variety of sources, such as banking information and CRM customer profiles, in order to respond to incoming customer service requests. If a particular request exceeds the power of the cat-bots, it is automatically transferred to a live service representative who can help the customer work to resolve the issue.

Expect more brands to utilize social messaging alongside AI and chatbots to help plug this speed gap. Social messaging, like Facebook messenger and Twitter, is ushering a new generation of customers who expect more and want things to be done fast.

-

Transparency more than ever

With legislations like GDPR now in full swing, consumers not to mention government bodies are ever ready to pounce on secrecy, poor form, or outright illegality. Brands that make mistakes in 2022 would be wise to own up and make amends as soon as possible to avoid a backlash.

-

Humanizing Digital

While AI and digital channels are both the mainstays of the 2022 banking customer experience; there is still something to be said about the value of human interaction. To that end, a growing number of banks offer a combination of AI and live customer service support, generating effective benefits while giving customers the personal touch they crave. Some financial institutions have taken this idea forward, trying different ways to make their chat-bots and other AI services feel human; Examples include providing chat-bots, using personalized chat openings, and emotion analysis to find emotions and respond appropriately.

Instead of making digital switching more difficult for many bank customers, especially older generations with limited digital knowledge and allowing these customers to fall out of the way, banks should redouble their efforts to facilitate the transition to online banking services. This will require banks to provide customers with additional support in the form of educational content, such as step-by-step tutorials, interactive videos and webinars, customer information bases, and more. The more relaxed and confident the customer is in working with digital channels and remote services, the better their financial customer experience becomes.

As we come out of what has been another exceedingly challenging year — one that has placed significant financial strain on many people — it’s vital that banks make even more of an effort to do right by their customers in 2022.

This is a guest post from Satish Krishnamurthy, Global Practice Head – BFSI at Tech Mahindra.

Author bio

Satish is a veteran banker with close to 20+ years of experience in Banking & Financial Services managing Sales, Solutions, GTM strategy, Transformation and Operations, He started his career as a banker working with top MNC banks such as Citibank, Standard Chartered Bank & ICICI wherein he was primarily responsible for managing back- end operations, customer service & collections across all retail lending products, Liabilities, Trade Finance & Cards. He has also worked extensively with leading BPO’s such as Sutherland, Accenture across multiple geographies (India, EMEA & ANZ) & also responsible for setting up a large SSC for a leading bank in UAE.

Satish is a veteran banker with close to 20+ years of experience in Banking & Financial Services managing Sales, Solutions, GTM strategy, Transformation and Operations, He started his career as a banker working with top MNC banks such as Citibank, Standard Chartered Bank & ICICI wherein he was primarily responsible for managing back- end operations, customer service & collections across all retail lending products, Liabilities, Trade Finance & Cards. He has also worked extensively with leading BPO’s such as Sutherland, Accenture across multiple geographies (India, EMEA & ANZ) & also responsible for setting up a large SSC for a leading bank in UAE.

Image by Colin Behrens from Pixabay