Becoming a trusted company is an absolute requirement of a winning strategy

January 7, 2019

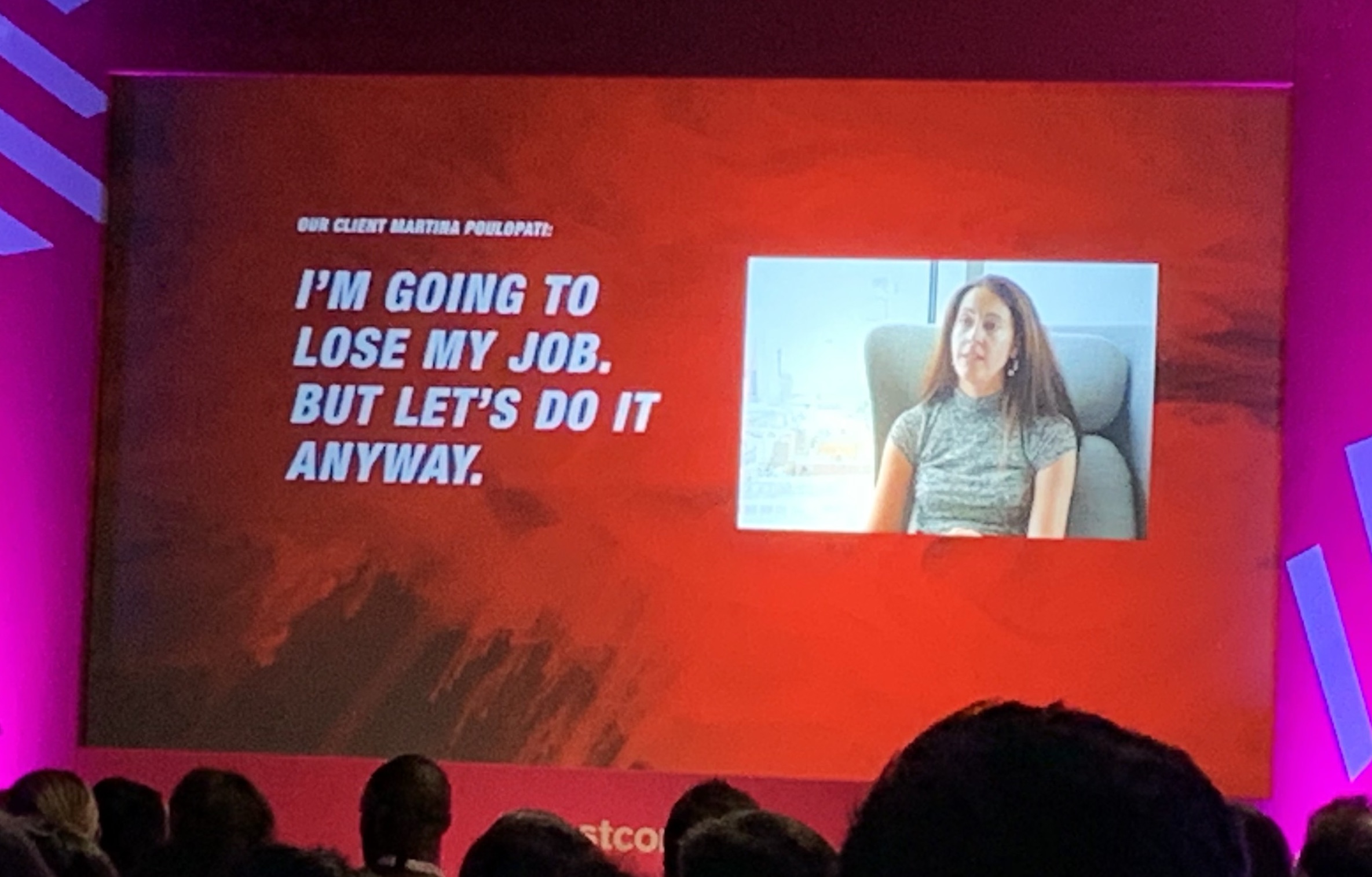

Are you prepared to be this brave for your customers?

January 16, 2019Going from good to great in customer experience – Interview with Rachel Haworth of Coventry Building Society

Today’s interview is with Rachel Haworth, Customer Experience Director, at Coventry Building Society. Particularly for non-UK readers, a building society is a financial institution that is owned by its members as a mutual organisation. Coventry Building Society is the second largest organisation of its kind in the UK with over 1.8 million members that save or have a mortgage with them. Rachel joins me today to talk about customer experience, the approach they have taken, the successes they have had, what it takes to have the highest customer satisfaction of any major bank or building society in the UK and what life is like with no targets.

This interview follows on from my recent interview – 9 Trends shaping the future of marketing and CX in 2019 – Interview with Jeremy Korst – and is number 290 in the series of interviews with authors and business leaders that are doing great things, providing valuable insights, helping businesses innovate and delivering great service and experience to both their customers and their employees.

Here’s the highlights of my chat with Rachel:

- The big difference between a bank and a building society is that we are owned by our members. So, we don’t have any shareholders and that allows us to be able to make decisions that are in the long term interests of both our current and future members.

- But, I think I think it’s important to note that even though we have mutual status, our success is dependent on strong leadership to ensure that the society is run in the proper way.

- Coventry Building Society, a financial services institution in the UK, doesn’t use sales incentive schemes or sales targets for any individual member of staff and haven’t done since 2010.

- The CX department was set up five years ago.

- Its purpose really is to take a holistic approach across the journey from a customer’s perspective and see what we could do.

- It’s important for any customer experience department to be able to show the commercial benefit of what they are doing.

- Starting with the savings journey, one of the things we did early on was we showed that if we could improve the journey from a customer’s perspective it would bring a significant amount of business benefits (increased sales and profitability, lower costs etc).

- Each journey creates a very different business case.

- In the savings journey, they found two days of delays in the application process that was causing and it was specifically those people looking at it online and extra phone calls and paper going back and forth. Removing this helped the customer and helped us too. It also created more loyalty from the customer.

- Coventry Building Society is the only financial service organisation in the UK that grew at a double digit rate before the financial crisis, during the financial crisis and since the financial crisis and they have done that without actually having any sales targets.

- They took sales targets (individual, team, department and branch) out of their branch network a good five or six years ago.

- The reason they did that was to ensure the customer got the right outcome.

- They now use NPS or customer recommendations to measure how they are doing but they don’t target staff on those metrics. However, staff do know what their score is and they see all of the detailed comments and everything that come back from customers.

- What that does is drive motivation for each of the branches to do as best as they possibly can from the customer’s perspective.

- Here’s some other stats about them:

- They have a savings growth that is twice the market rate and mortgage growth rate that is four times the market rate.

- They are the most cost efficient building society in UK.

- They have the highest customer satisfaction of any major bank or building society.

- They are ranked 1st for mortgages and savings by Fairer Finance.

- They are one of the Sunday Times Top 100 companies.

- 92% of their staff say “I feel proud to work for this organisation”; and

- 97% of their staff say “This organisation can be trusted by its members”.

- The society has always had its members interests at its heart but the establishment of the CX department was to push them to go further and go from good to great.

- Their CEO attends every induction for new employees. That means taught the CEO will take an hour or an hour and a half every fortnight out of his diary to see new employees very early on their first day. Rather than talking about corporate strategy or growth, he talks about values of the organization and their culture.

- The tone of culture gets set at the very top.

- A leadership team that’s encouraging members of staff to think about each other as people and to work together collaboratively means that you are more likely to get good staff engagement and, in turn, they are likely to do the right thing for your customers as well.

- Coventry Building Society’s success is organised around 10 simple principles covering all of the things that are important to them…..how they treat their members/customers, who they treat each other, how they operate in the community, how they manage their business etc.

- We haven’t set any separate Customer Experience vision or goals. What we do is completely aligned with the strategic vision and goals.

- One example of how they operate comes from a situation during the credit crisis where the majority of financial organizations lowered their interest rates. This was to the detriment of their customers but was done to safeguard their commercial funding position. Coventry Building Society had the option to follow the market. However, they decided not to follow the market and they chose to pay their members better rates than they could have gotten away with. They say ‘we will always pay the best rates that we can afford to pay’. They could have made millions of pounds worth more profits in that year but they chose to do the right thing for their members instead.

- Looking at things holistically, it’s fascinating how everything becomes increasingly connected not just in an organization but also in people’s lives.

- Rachel’s best advice: You’ve got to win the hearts and minds of your board. But, start with the mind – the tangible value that you can offer.

- There is always improvement that can be made.

- There’s a characteristic shared by many leading organizations that lead in the CX space and that is that they are both restless and relentless when it comes to improvement.

About Rachel

Rachel Haworth is Customer Experience Director at Coventry Building Society, the second largest organisation of its kind in the UK and has over 1.8 million members that save or have a mortgage with them.

Rachel Haworth is Customer Experience Director at Coventry Building Society, the second largest organisation of its kind in the UK and has over 1.8 million members that save or have a mortgage with them.

Rachel has over 20 years’ experience of Marketing and Customer Experience leadership in Financial Services, having managed First Direct’s brand and innovation initiatives before joining Coventry Building Society. Initially leading the Product & Marketing strategy, Rachel went on to set up a team dedicated to Customer Experience and Conduct Risk. Coventry Building Society is now considered a leader in customer experience in the UK, ranking highly in the ‘top 100 UK companies for customer experience in the UK’

You can find out more about Coventry Building Society at their website, say Hi to them or follow them on Twitter @CoventryBS and do connect with Rachel on LinkedIn here.

..

..

Thanks to Pixabay for the image.